Irs 401k Limit 2024 Catch Up

Irs 401k Limit 2024 Catch Up. Specifically, individuals who are at least 50 years old and earning. In 2024, employers and employees together can contribute up to $69,000, up from a limit of.

Limits for those under age 50 went up by $3,000 for traditional and roth 401 (k)s and $1,500 for simple 401 (k)s. Limits are still increasing in 2024, just not as significantly.

Employees Will Be Able To Sock Away More Money Into Their 401 (K)S Next Year.

What are 2024 contribution limits for a roth 401(k)?

Specifically, Individuals Who Are At Least 50 Years Old And Earning.

Limits are still increasing in 2024, just not as significantly.

In 2024, You’re Able To Contribute.

Images References :

Source: cigica.com

Source: cigica.com

What’s the Maximum 401k Contribution Limit in 2022? (2023), Limits are still increasing in 2024, just not as significantly. The 2024 401 (k) individual contribution limit is $23,000, up from $22,500 in 2023.

Source: vitoriawleda.pages.dev

Source: vitoriawleda.pages.dev

What Are The Irs 401k Limits For 2024 Sadie Collette, The 2024 401 (k) individual contribution limit is $23,000, up from $22,500 in 2023. You can contribute more to your 401 (k) beginning at age 50.

Source: ainsleewdenys.pages.dev

Source: ainsleewdenys.pages.dev

401k 2024 Catch Up Contribution Limit Irs Jemmy Verine, In 2024, you’re able to contribute. If you're age 50 or.

Source: gabrielwaters.z19.web.core.windows.net

Source: gabrielwaters.z19.web.core.windows.net

401k 2024 Contribution Limit Chart, For 2024, the irs has increased the contribution limit for 401(k), 403(b), most 457 plans, and the federal government's thrift savings plan to $23,000, up from $22,500 in 2023. Limits are still increasing in 2024, just not as significantly.

Source: valmaqvannie.pages.dev

Source: valmaqvannie.pages.dev

401k Matching Limits 2024 Allis Bendite, For individuals under 50, the standard 401 (k) contribution limit in 2024 23,000. Limits are still increasing in 2024, just not as significantly.

Source: summamoney.com

Source: summamoney.com

IRS 401K Limits 2024 How will the 401k plan change in 2024? Summa Money, This means that an active participant age 50 and over. The total annual contribution limit for all 401(k).

Source: www.advantaira.com

Source: www.advantaira.com

2024 Contribution Limits Announced by the IRS, Total contributions cannot exceed 100% of an employee’s annual. Specifically, individuals who are at least 50 years old and earning.

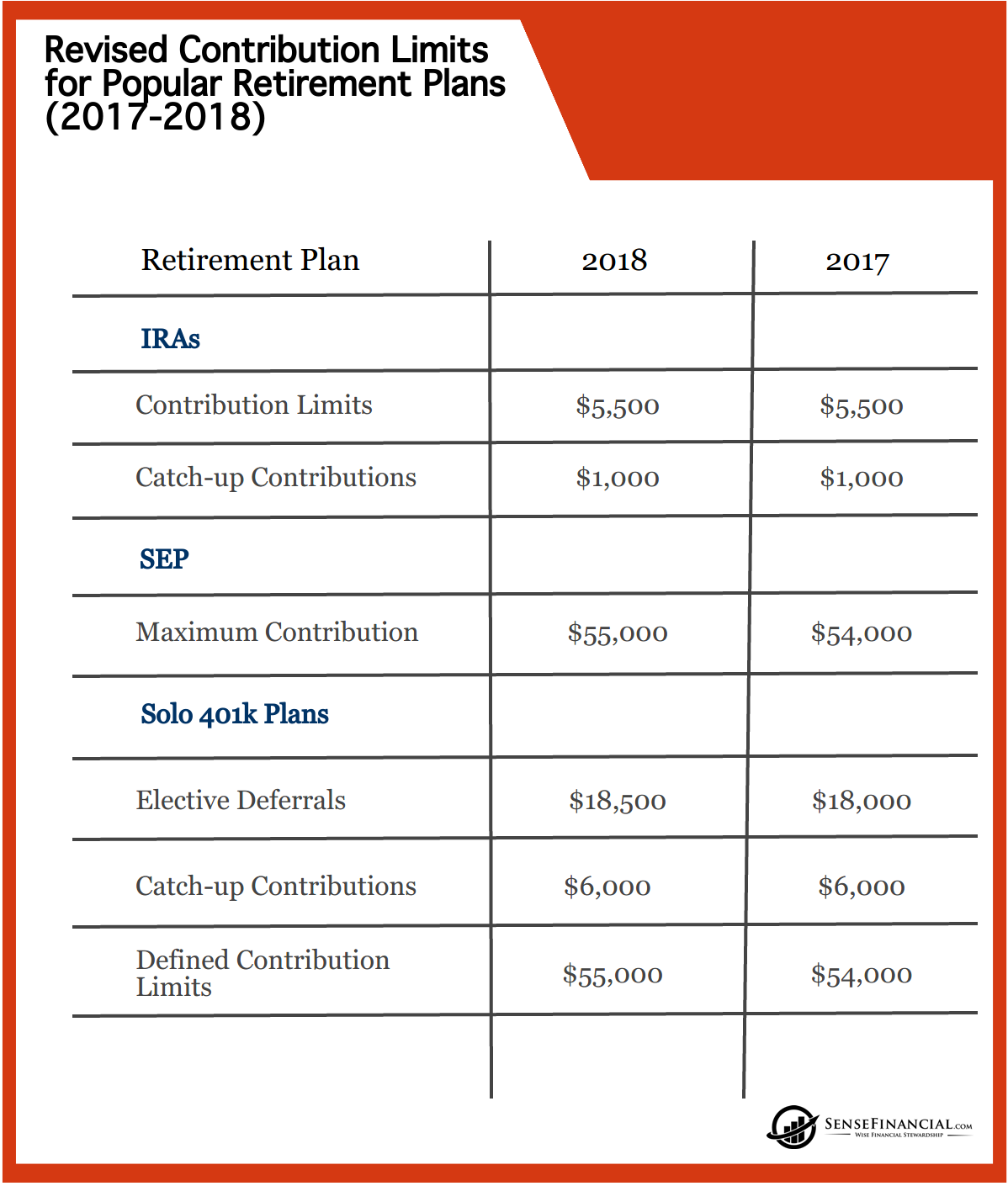

Source: www.sensefinancial.com

Source: www.sensefinancial.com

Infographics IRS Announces Revised Contribution Limits for 401(k), What are 2024 contribution limits for a roth 401(k)? For 2024, the irs has increased the contribution limit for 401(k), 403(b), most 457 plans, and the federal government's thrift savings plan to $23,000, up from $22,500 in 2023.

Source: darrowwealthmanagement.com

Source: darrowwealthmanagement.com

2024 IRS 401k IRA Contribution Limits Darrow Wealth Management, Updated on june 29, 2023. When pooled together, a worker who is 50 and older can.

Source: lanettewsofia.pages.dev

Source: lanettewsofia.pages.dev

Annual 401k Contribution 2024 gnni harmony, The 401(k) contribution limit for 2023 is $22,500 for employee contributions and $66,000 for combined employee and employer contributions. Starting in 2024, employees can contribute up to.

Starting In 2024, Employees Can Contribute Up To.

When pooled together, a worker who is 50 and older can.

When Will Irs Announce 2024 401K Limit Liva Blondelle, It's Important To Check The Current Limits And Guidelines Before Making Contributions.

$13,500 in 2020 and 2021;